tax loss harvesting wash sale

To do it you simply need to lock in a loss by selling the. But you need to familiarize yourself with the wash sale rule which.

The Irs Untold Secret Tax Loss Harvesting Seeking Alpha

It appears XAW holds FUNDS not individual stocks.

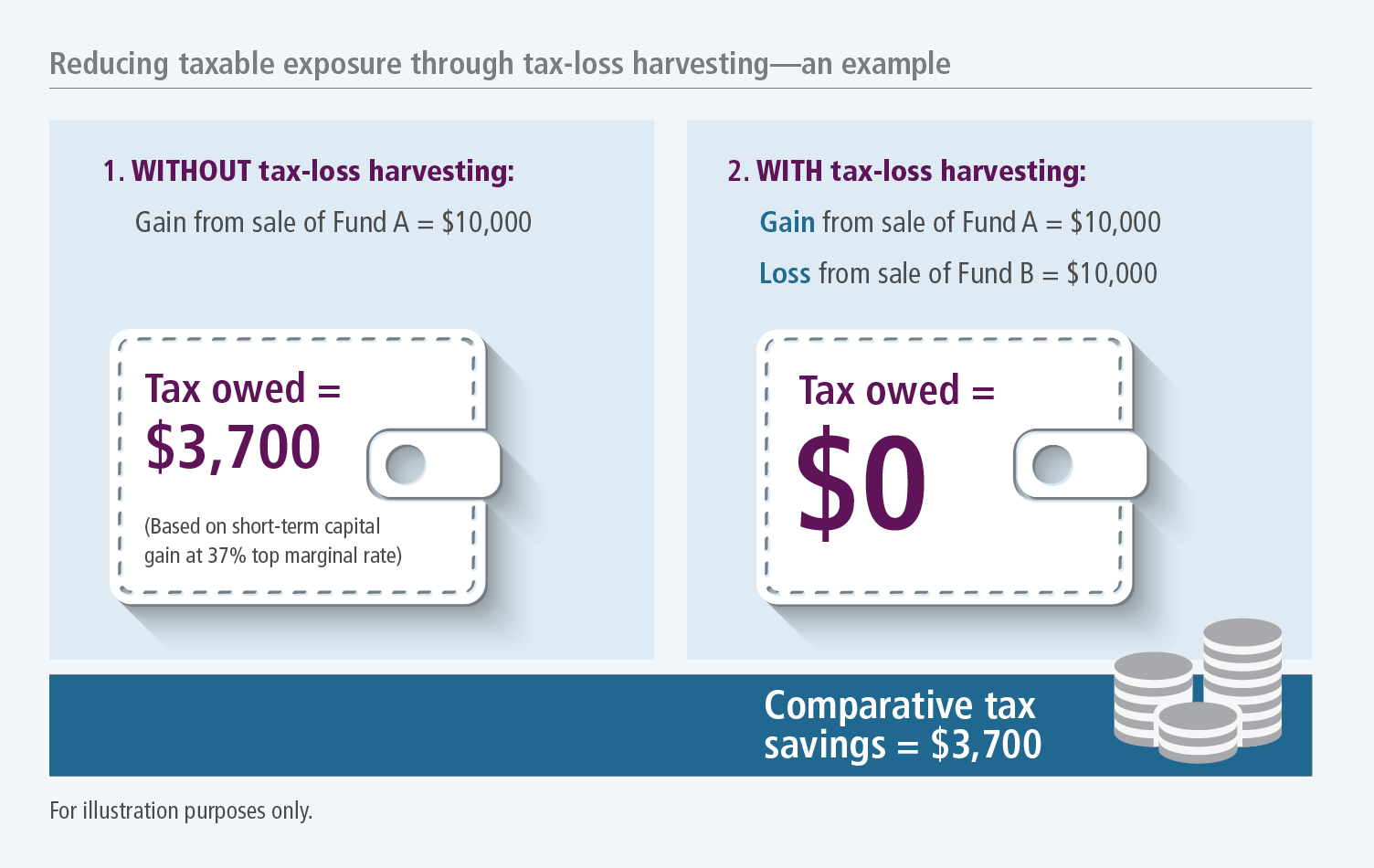

. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. To claim a loss for tax purposes. Be the first to know about new foreclosures in an area.

Tax-loss harvesting may now be more attractive with the SP 500 Index down by nearly 14. The sale of tax lien certificates is a solution to a complex problem Middlesex County New Jersey recovers lost revenue needed to fund local services the property owner gets more time to. If you buy the same.

I currently hold XAW total world ex canada. Investors looking to write off any capital losses need to beware of wash sales which can derail their attempt to claim a deduction during tax time. Once losses exceed gains you can subtract up to 3000 per year from regular income.

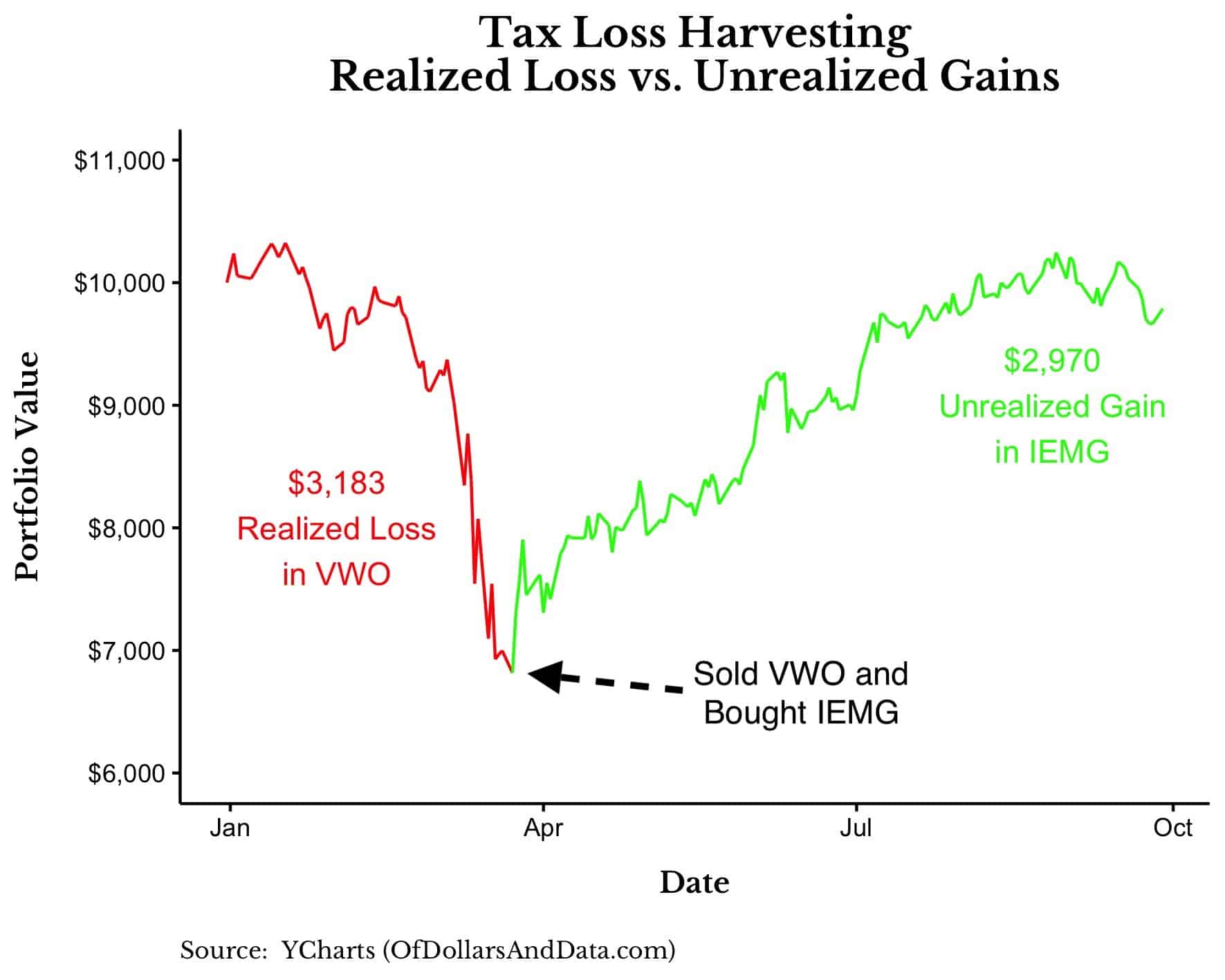

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. You can achieve the same goal with a less expensive alternative approach. Like many Im down quite a bit in my portfolio.

The wash sale rule is avoided because December 22 is more than 30 days after November 21. Map More Homes in Old Bridge. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss.

Setup email alerts today Click Here. Use tax-loss harvesting to take advantage of capital losses eligible portfolios proactively sell underperforming investments and replace it with a similar position. 414 HARVEST MILL WAY is a Residential 4 Families or less property.

In the United States reporting wash sale loss adjustments is done on the 1099-B form. For Sale - 13 Harvest Ave East Hanover Twp NJ. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their.

Free service which allows you to look up 414 HARVEST MILL WAY HARRISON NJ property tax assessment records. The opposite of a. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

This Single Family House is 4-bed 3-bath -Sqft listed at 695000. A wash sale is one of the key. According to Forbes most brokers dont report wash sale WS loss calculations during the year.

What Is The Wash Sale Rule How Do I Avoid It

What Advisors Need To Know About Tax Loss Harvesting

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Tax Loss Harvesting Flowchart Bogleheads Org

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

Us Tax Law And Cryptocurrency Part 2 Tax Loss Harvesting And Wash Sales R Cryptocurrency

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Planning To Tax Loss Harvest Beware Of The Wash Sale Tax

Understanding The Wash Sale Rule What It Is And How To Avoid It Kiplinger

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

How Tax Loss Harvesting Can Save You Taxes This Year

When Not To Use Tax Loss Harvesting During Market Downturns

Top 5 Tax Loss Harvesting Tips Physician On Fire

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Tax Loss Harvesting And Wash Sales Marotta On Money

Crypto And Tax Loss Harvesting Wash Sale Rules And The Benefits Downsides R Cryptocurrency

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data